ESPC House Price Report - February 2012

- The average house price in Edinburgh is £201,657 following an annual fall of 1.7%.

- Prices in most areas of the Capital have returned to levels seen at the start of 2009, though smaller properties have generally seen larger falls.

- There has been a sharp increase in the number of sales recorded with sales across East Central Scotland up 20% on an annual basis.

- The rise in sales has not been caused by a rush in activity from first-time buyers prior to the end of the Stamp Duty holiday on 24 March.

- Sellers today are more willing to accept offers below Home Report valuation which has helped fuel the rise in completed sales.

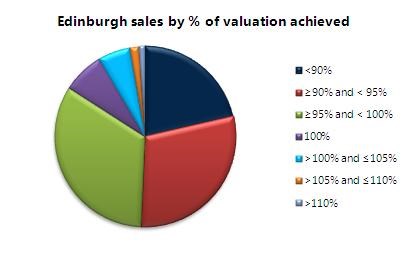

- During the last three months 14% of properties sold achieved their Home Report valuation, down from 16% a year ago.

- The number of homes coming onto the market has also risen. New insertions are up 10% annually during the first two months of 2012.

Overview

The average house price in Edinburgh fell by 1.7% annually during the three months to February. Latest figures from ESPC - the largest property marketing firm in East Central Scotland - reveal that the average selling price of a property in the Capital between December and February was £201,657, down from £205,191 during the same period a year ago.

Whilst house prices are lower than they were a year ago there has been a sharp increase in the number of homes selling. During the first two months of the year almost 900 sales were recorded - 18% higher than a year ago and the highest level since 2008.

Whilst house prices are lower than they were a year ago there has been a sharp increase in the number of homes selling. During the first two months of the year almost 900 sales were recorded - 18% higher than a year ago and the highest level since 2008.

David Marshall, business analyst with ESPC commented: "Although prices are lower than they were a year ago we've seen a lot more sales being completed than in recent years. Interestingly, this doesn't appear to have been caused by a rush of activity from first-time buyers looking to beat the deadline for the Stamp Duty exemption. In fact, properties in the affected £125,000 to £250,000 bracket actually account for a lower percentage of sales than they did at the start of 2011. Instead what we're seeing is that sellers today are increasingly willing to accept offers below Home Report valuation and this has helped a number of sales to reach completion.

"It's important to note, of course, that sales are still some way below what would have been considered normal levels prior to the credit crunch but the upturn in activity we've seen so far this year is certainly positive news for those looking to move home."

Edinburgh

The average house price in Edinburgh fell by 1.7% annually during the three months to February and now stands at £201,657. Although prices in the City Centre showed a year-on-year increase of 6.3%, values in other areas were generally found to be lower than they were a year ago.

In Stockbridge and Comely Bank a decrease of 8.3% brought the average price of a two-bedroom property down from £220,477 to £202,143 whilst a 3.8% fall in Marchmont and Bruntsfield means the average price of a similar property in these areas is now £243,962.

In most cases these decreases brought prices back to levels seen at the start of 2009, but more sustained decreases have been witnessed in the value of smaller properties. In Gorgie and Dalry the average price of a one bedroom flat now stands at £94,412 - down 12% annually and some 26% below levels observed at the peak of the market.

David Marshall said: "Recently we've seen a greater willingness from sellers to accept offers below the Home Report valuation which has brought prices down and increased the number of completed sales. Over the last three months one in five sales in the Capital have been completed for more than 10% below their Home Report valuation which gives you an idea of the success sellers have had in negotiations.

David Marshall said: "Recently we've seen a greater willingness from sellers to accept offers below the Home Report valuation which has brought prices down and increased the number of completed sales. Over the last three months one in five sales in the Capital have been completed for more than 10% below their Home Report valuation which gives you an idea of the success sellers have had in negotiations.

"Although there are fewer homes on the market than at the start of 2011 the number of properties for sale is still a little above what would be considered normal levels for this time of year meaning the balance of power in negotiations should continue to favour buyers in coming months."

Lothians

West Lothian saw the sharpest fall in house prices of any area in the three months to February. A 26.6% annual decrease took the average selling price of a property in the area to £131,899. The change in price was largely caused by a change in the mix of properties selling in the area. Properties with four or more bedrooms accounted for less than 22% of sales in the area during the last three months compared to 30% a year ago.

David Marshall explained: "Although house values in West Lothian are lower than we saw at the start of 2011 the reason for the dramatic shift we've seen here is that there has been a rise in the proportion of sales accounted for by smaller properties. We should see the mix in properties selling returning to more normal levels in months ahead at which point the average price will fall more in line with levels we saw last year."

East Lothian was one of the few areas of East Central Scotland to see house prices rise. A 3.4% increase took the average house price in the area to £182,300. Meanwhile, a 4.1% fall in Midlothian meant that the average price of a property sold in the area between December and February was £156,134 having stood at £162,899 a year ago.

Dunfermline

The average price of a property in Dunfermline during the three months to February was £138,311 - up 1.8% from £135,890 a year ago. The number of homes selling rose sharply, with completed sales in the town so far in 2012 up 50% annually.

Commenting on these figures David Marshall said: "House prices in Dunfermline have been particularly stable recently. Over the last seven months the annual change in average price in the town has never been more than 3% in either direction. This, coupled with the recent rise in sales volumes we've seen in the town, will be welcome news for those looking to sell, though competition among sellers remains high meaning those looking to a secure a quick sale may well have to show some wiggle room on price when it comes to negotiations with potential buyers."

Got a question? Read our House Price Report FAQs.

Want to know about previous months and years? Read our historical house price data.